1st Jan, 5am in the morning. Wake up, get a cup of coffee and turn on the computer. Wala, interest from CPF savings and contributions over the past year is in. Last year around this time, I also shared on my CPF Interests Update – For 2019.

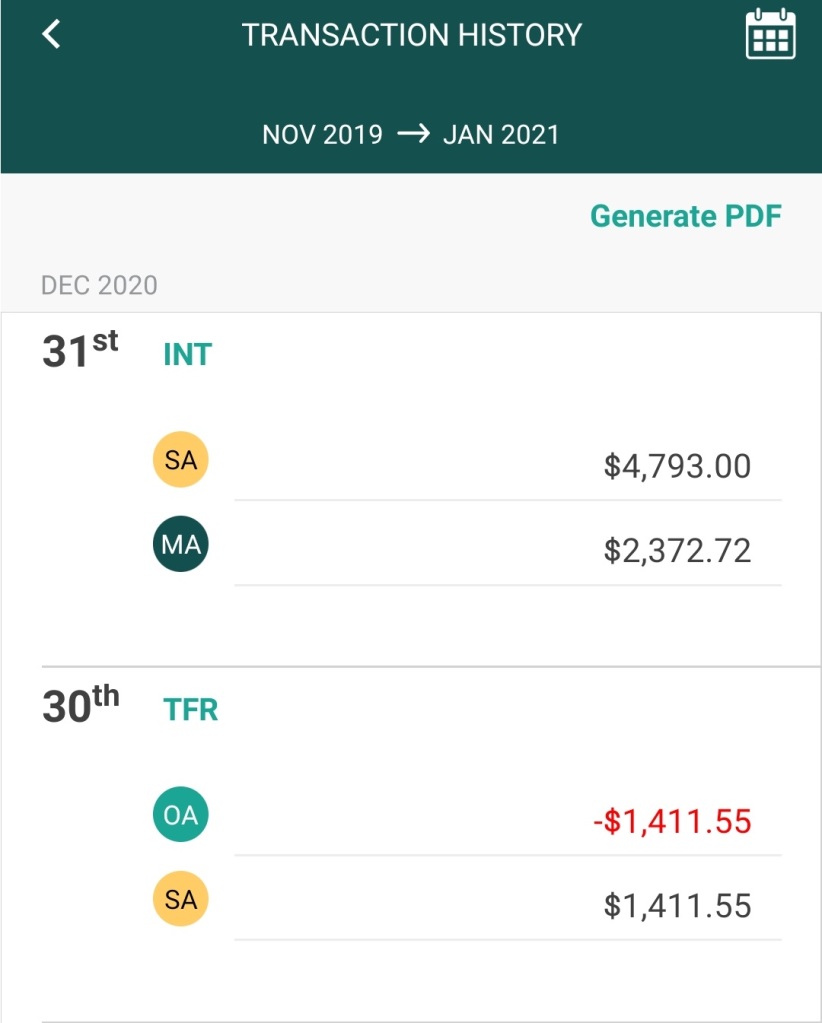

Ended off Dec 2020 hardly 2 days ago at:

| OA | SA | MA | |

| Dec 20 | $0 | $114,913.95 | $60,000.00 |

| Interests | $0 | $4,793.00 | $2,372.72 |

| *Expected* Interests | $0 | $7,165.72 | $0 |

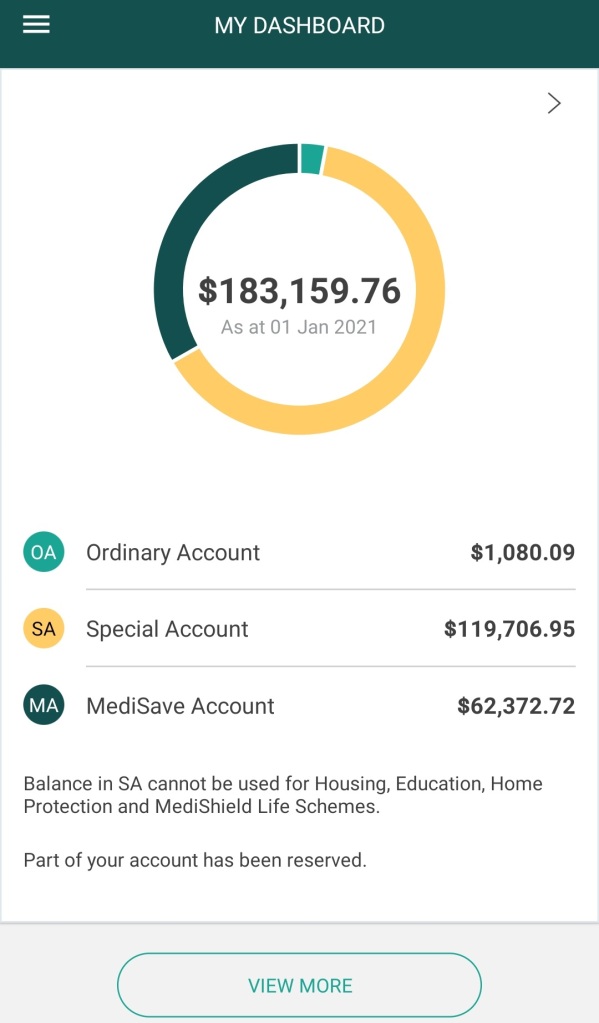

The interests for 2020 stands at $7,165.72, up from $5,486.96 for 2019.

The MA cap up to 31 Dec 2020 was $60,000. Revision for MA cap to $63,000 begins on 01 Jan 2021. Therefore, the interests earned for MA account for 2020 would overflow to SA. The overflow will be rightfully corrected later on in the day.

SA balance currently stands at $122,079.67, more than half of 2021 FRS or 65.6% of the journey.

*2021 FRS is $186,000 (up from $181,000 in 2020)

Happy 2021! I am first to reply to your article in 2021!

The interest from MA should overflow to OA, not SA.

LikeLike

MediSave Account savings above the Basic Healthcare Sum (BHS) will be transferred to your CPF Special Account (SA) or Retirement Account (RA), which have interest rates equal to or higher than that of the MediSave Account. The BHS cap and overflow arrangement are designed to avoid over-savings in MediSave Account and to supplement the member’s retirement savings, which can be withdrawn per the usual CPF withdrawal rules. For members who have met the Full Retirement Sum in their SA or RA, the savings in excess of the BHS will be transferred to the Ordinary Account (OA).

LikeLike

Hi there! how does this work if i want to start working on mine?

LikeLike

There are a few ways around it, though I am assuming you are less than 55.

(1) Top-up cash to your SA

(2) Top-up cash to your MA

(3) Transfer from OA to SA

(4) If you are self-employed, you may do voluntary contribution to ALL 3 accounts (OA, SA, MA) for tax relief

LikeLiked by 1 person

To also confirm, I experienced it in my MA/SA, after the re-adjustment.

https://toc.net/2020/01/04/update-to-cpf-interests-update-for-2019/

LikeLike

Strange as I saw the interest from MA transfered to OA this morning. I can’t upload image here, else can show the cpf transaction just happened this morning.

Haha… If course I wish the MA interest is transferred to SA.

LikeLike

Will be adjusted soon, it always does. Haha

LikeLike

So I went to take a look at the transactions from Dec 2019 to Feb 2020. Same thing happened, my interest from MA over flew to OA. And was not adjusted or transfered to SA after that, even in Feb 2020…

Maybe have to call up Cpf liao.

LikeLiked by 1 person

It transfers to OA if your SA is above FRS.

LikeLike

My SA is below FRS as a large portion had already been taken out for investment.

LikeLiked by 1 person

Investment amount is considered in the count for FRS. So no way around it. You most probably have already reached FRS level in SA.

LikeLiked by 1 person

Ahhh. I see. Amount pumped out from SA for investment is considered for FRS too.

Yes. If that is the case, then it makes sense why interest from MA over flew to OA and not SA.

Thanks for enlighting this.

LikeLiked by 1 person